Invest In A Brighter Future (For Both The World And Your Wallet)

It’s time to buy a new car. Or maybe, a new apartment. Perhaps you are moving to a new city. All of these decisions require a lot of thought and research ahead of time, so you can make the best decision for your life, while also being aware of how potential decisions would affect the rest of the world. For example, you may choose a more efficient car, which both keeps fuel money in your pocket and releases less emissions into the atmosphere.

As consumers, we make choices that align with our values every day, in nearly every purchase we make. According to the Morgan Stanley Institute for Sustainable Investing, nearly nine in ten US consumers say that they will purchase a product because of a company’s stance on an issue they care about. The choice to invest should be made the same way, because your investment strategy affects so much more than just your own financial gain.

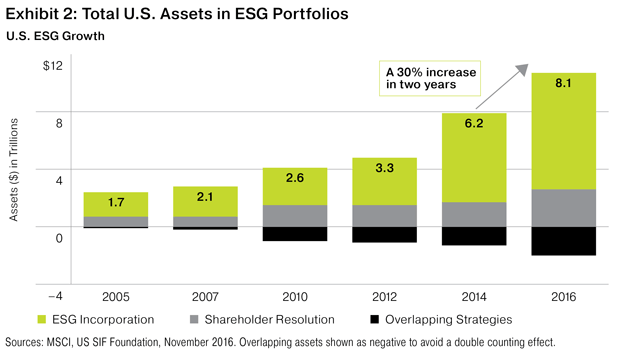

What is sustainable investing? Sustainable investing is a broad term for investment approaches that considers the impact of environmental, social and governance (ESG) factors. ESG Investing, as it is most commonly referred to, is growing in popularity. In 2016, ESG-focused strategies represented $8.1 trillion of the $40.3 trillion in professionally managed assets in the United States.

in 2018, 84% of individual investors said they’re interested in investing in a positive impact on the environment and social welfare.

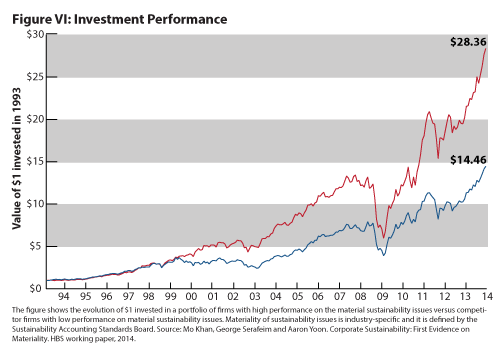

The common misconception is that to invest in companies that are driving positive impacts, you must sacrifice earnings. However, research shows the opposite is true.

In fact, studies show that companies that are committed to creating a positive impact tend to perform better than companies that don’t. In one meta-analysis, 88% of studies found that companies that adhered to social or environmental standards showed better operational performance, and 80% of studies showed a positive effect on stock price performance. One such study from Harvard Business School illustrates that if one dollar was invested in 1993 in a portfolio of public companies with the sole goal of growing and increasing profits, the dollar would be worth $14.46 in 2013. However, if that same dollar was invested into companies that prioritized environmental and social issues during the period of their growth, that dollar would be worth a whopping $28.36 after the same period of time.

Yes, you can invest in what you believe in, not just in what you believe will give you the highest returns. It’s better for your wallet, for the economy, and for the environment. Use your investment strategy to make an impact .

I am CPO and Co-Founder of Cred. Cred is a disruptive WealthTech startup aimed at enabling financial advisors and institutions to truly personalize each of their retail clients’ portfolios, based on their unique backgrounds, financial situations and preferences. This is the way investing will work in our generation, and we’re excited to be pioneers on this journey.

Feel free to contact me at ilan@credinvest.co, and find us on Facebook and LinkedIn!

A special thanks to Olivia Johnson for preparing this article!